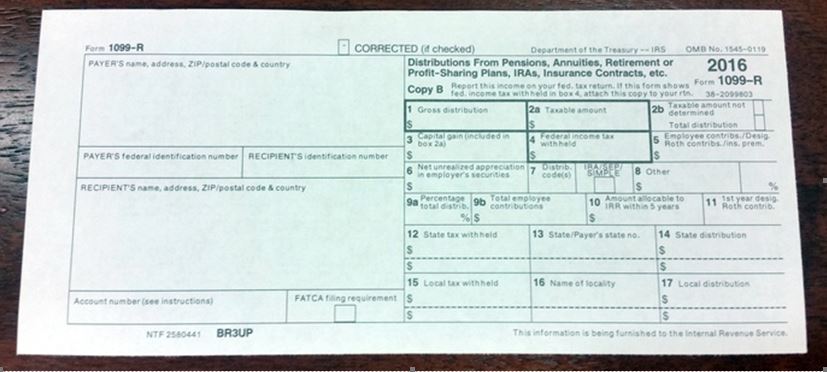

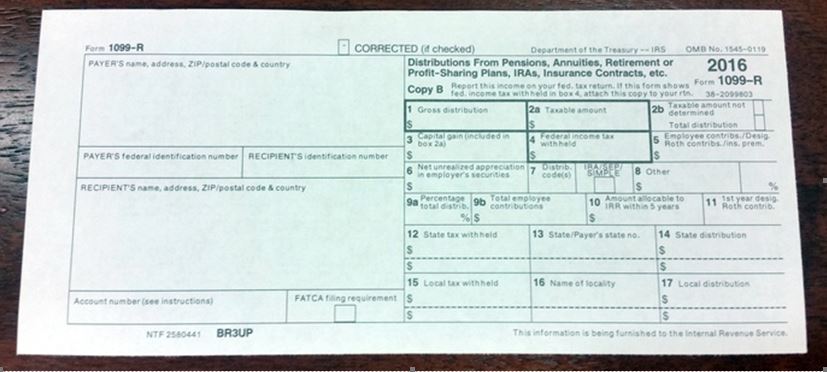

Understanding Your 1099-R Form

Mailed to you by January 31st

This form lists your 2016 retirement benefit income from KCPSRS. You will need this form to file your income tax return. The 1099-R provides the following information for the 2016 calendar year:

1 Total gross distribution (The total amount paid to you by KCPSRS for the calendar year.)

2a Total taxable amount (The portion of your total benefit received during the calendar year that should be considered taxable income.)

4 Taxes withheld (The total amount of federal income tax withheld during the calendar year.)

5 Employee contributions/Desig Roth contributions (Difference between box 1 and box 2a. The portion of employee contributions that were taxed prior to being received by KCPSRS and excludable from the year’s gross distribution.)

7 Distribution Code(s) (Code identifying the type of benefit being paid – see chart on page 2 of your 1099-R.)

12 State tax withheld (The total amount of Missouri income tax withheld during the calendar year.)

Contact your tax advisor with any questions about this information.