For retirees who are already receiving social security benefits, the Social Security COLA for 2021 was 1.3%. The Social Security Administration announces the new rate annually in October. Once the new COLA is confirmed, it will go into effect in January 2022.

Per Missouri law (RSMO 169.324.3,) the Kansas City Public School Retirement System (KCPSRS) is prohibited from granting a COLA unless the following two requirement are met: Read more here

Jim Roehner August 5th, 2021

Posted In: Uncategorized

Simple Tech Solutions That Can Make Life Easier for Seniors

Feeling overwhelmed by today’s technology? You are definitely not alone! Many seniors feel like the newest tech is far too complicated to use, and they also feel anxious about adding new tech to their lives. If you can find tech that’s comfortable to use, however, you can actually improve your quality of life. So, if you’re interested in all the ways that technology can boost your life, you need to read through the following tech facts.

Tech Can Be Accessible for Seniors

Many electronic devices on the market cater to different age groups. Take tablets, for instance; not only are they portable and convenient to use, but they are similar to computers in terms of capability and versatility, and they’re easy to use. Plus, many tablets, such as the iPad 10.2, include accessibility tools like voice controls and magnifiers to accommodate hearing and vision needs. The Sony Xperia Z4 tablet is also a good tablet option for seniors because it is lightweight and allows you to arrange your apps however you’d like.

Tech Can Keep Retirement Expenses Low

Learning how to budget your retirement funds is important. For many seniors, this means looking for ways to reduce living expenses by up to 70 to 80 percent. That can take some major effort, but it shouldn’t take away from your ability to enjoy your golden years.

If one of your favorite ways to relax is to watch your favorite movies and shows, know that, with the right tech, you can reduce your cable bill without giving up your preferred entertainment. Sure, you could haggle with the cable company, but why not make things even simpler by opting for a streaming device instead of a pricey cable or satellite service? Streaming sticks make it easy for seniors to enjoy their favorite TV shows and movies without the need to buy a smart TV.

Tech Can Help Keep Seniors Safe at Home

When you think about tech, you likely think in terms of entertainment. If you plan on aging in place in your home, however, you should also know that easy-to-use smart tech can also provide an added layer of safety for seniors. For example, smart lighting can keep lighting around your home even throughout the day and night, which can help prevent a serious fall. Smart home tech can also help you remember to take medications or turn off burners on your stove. In addition to smart tech, online security software and services can help you stay safe when browsing the internet. There’s a lot of info out there on how to protect your devices, so visiting an online hub of cybersecurity tips and tutorials is a good place to start.

Tech Can Keep Seniors Connected to Others

For seniors who live with mobility issues or chronic pain, getting out of the house can be a challenge. That can leave these seniors vulnerable to feelings of isolation and depression, but recent research shows that access to social media can reduce these negative effects. Older adults who connect with friends, family, and current events through social media tend to be at less of a risk for depression, and they also tend to be able to better manage pain symptoms. Investing in a simple-to-use laptop can be a good way to keep yourself connected through social media platforms, like Facebook and Instagram. Look for a laptop that’s lightweight with a large screen and long battery life, so you can take it anywhere.

Tech Can Keep Senior Homes More Comfortable

Comfort is key to enjoying your golden years. So, think about picking up a smarter thermostat, like Nest, for your golden years home. This thermostat is very simple to use and actively learns the temps that keep you cozy throughout your home, so you don’t have to adjust the temperature as often. Using a smart thermostat can also help keep your cooling and heating bills low, which is an added bonus for retirees on a tight budget. These thermostats can be a challenge to install, so be sure to use the link provided above to get help or ask a loved one to assist with setting your thermostat up.

Tech doesn’t have to be overwhelming for seniors. If you invest your money in tech that’s easy to use and provides benefits, you can actually reduce your feelings of anxiety. So, stop feeling overwhelmed by using tech and start putting it to use to improve your quality of life.

Photo Credit: Unsplash

Jim Roehner September 15th, 2020

Posted In: Uncategorized

Investments

Some of our members have expressed concern that recent investment market downturns will impact their KCPSRS benefits. It is important to remember that the KCPSRS pension plan is a defined benefit (DB) plan, meaning that the amount of your annual pension benefit is defined by a formula and will be paid over your lifetime. Your KCPSRS pension benefit will not fluctuate with investment market ups and downs.

Like most investors, KCPSRS’ total fund investment portfolio has been negatively impacted during the first quarter of 2020. However, unlike individual investors, the assets of KCPSRS are invested over a very long-term time horizon. The KCPSRS portfolio is well-diversified and designed to weather the volatility of financial markets. The assumed long-term investment rate of return used for the annual actuarial valuation of KCPSRS is 7.50%. As of April 30, 2020, our long term (since July 1989-first available data), investment return average was 7.65%, which includes other downturns in the markets such as in 2000-2002, and 2008. Total fund returns for May are still being compiled, but investment markets rose slightly and continue to offset some of the downturns from the 1st quarter of 2020.

Please know that the KCPRS Board of Trustees and staff are committed to managing KCPSRS’ assets in a prudent manner to ensure the security of your benefits and the sustainability of the System.

Operations During Pandemic

Our staff didn’t miss a beat in getting benefits paid in March, April, and May and they will continue to do so this month, next month, and so on.

The KCPSRS office remains closed to visitors to protect the health of members and staff. While still largely working remotely from home, KCPSRS staff rotate days in the office.

We are continuing to accept retirement applications through mail or email.

KCPSRS staff are available to you by phone and email. Please contact us with any questions you may have about your KCPSRS benefits.

If your call goes to a voice mail, please make sure you leave your phone number and be assured we will call you back. We are all in this together – and we will get through this, together! Thank you for your patience as we continue to serve you. Please be safe and take care.

KCPSRS Contact Information

By phone: 816-472-5800

By email: kcpsrs@kcpsrs.org

By mail: 3100 Broadway, Suite 1211 Kansas City MO 64111

Best regards,

Christine Gierer, Executive Director

Jim Roehner June 11th, 2020

Posted In: Uncategorized

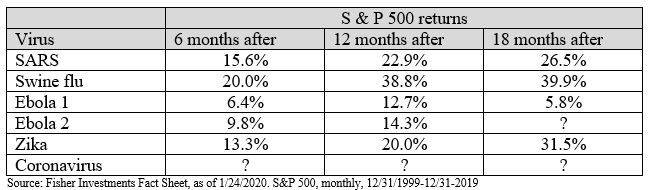

The public stock markets have been rocked this week largely due to news of the coronavirus. Historically, global financial markets have reacted negatively to other pandemic outbreaks and then moved on quickly from disease-related market pullbacks. Markets quickly resumed after other infectious diseases outbreaks: the SARS (severe acute respiratory syndrome) outbreak in 2003, the swine flu in 2009, the Ebola outbreak in 2014 and 2018, Zika in 2016.

While the ultimate magnitude of the impact of the coronavirus remains uncertain, the important thing is: the retirement benefits of members of the Kansas City Public School Retirement System (KCPSRS) remain the same and secure.

This retirement plan is intentionally designed to withstand investment market volatility and fluctuations. The KCPSRS investment portfolio is diversified in various types of assets which include, not only public stocks, but fixed income (bonds), real estate, and private investments. KCPSRS is invested for the long-term and is well-positioned to meet shorter-term cash flow needs to pay benefits.

Jim Roehner February 28th, 2020

Posted In: Uncategorized

KCPSRS is hosting pre-retirement seminars to help you prepare for your transition to retirement. Seating is limited so RSVP to 816.472.5800

Topics included will cover: Retirement Benefits, Social Security, Retirement Medical Program (Select Account)*, Tax Deferred Personal Investment Accounts (Optional)

*for School District Employees only

Jim Roehner December 4th, 2017

Posted In:

KCPSRS is hosting pre-retirement seminars to help you prepare for your transition to retirement. Seating is limited so RSVP to 816.472.5800

Topics included will cover: Retirement Benefits, Social Security, Retirement Medical Program (Select Account)*, Tax Deferred Personal Investment Accounts (Optional)

*for School District Employees only

Jim Roehner December 4th, 2017

Posted In:

KCPSRS is hosting pre-retirement seminars to help you prepare for your transition to retirement. Seating is limited so RSVP to 816.472.5800

Topics included will cover: Retirement Benefits, Social Security, Retirement Medical Program (Select Account)*, Tax Deferred Personal Investment Accounts (Optional)

*for School District Employees only

Jim Roehner December 4th, 2017

Posted In:

KCPSRS is hosting pre-retirement seminars to help you prepare for your transition to retirement. Seating is limited so RSVP to 816.472.5800

Topics included will cover: Retirement Benefits, Social Security, Retirement Medical Program (Select Account)*, Tax Deferred Personal Investment Accounts (Optional)

*for School District Employees only

Jim Roehner December 4th, 2017

Posted In:

KCPSRS is hosting pre-retirement seminars to help you prepare for your transition to retirement. Seating is limited so RSVP to 816.472.5800

Topics included will cover: Retirement Benefits, Social Security, Retirement Medical Program (Select Account)*, Tax Deferred Personal Investment Accounts (Optional)

*for School District Employees only

Jim Roehner December 4th, 2017

Posted In:

National Retirement Security Week

This is the 10th anniversary of Save for Retirement Week, established as part of the Pension Protection Act of 2006. It is a perfect time to pause and reflect on your retirement plan. Think of the week as a reminder, similar to a grocery list.

Consider what you have in your retirement “pantry” — your KCPSRS defined benefit, your estimated social security, any personal savings (457plan, IRA, 401k). You can estimate your KCPSRS retirement using My Account and your social security benefits using my Social Security. https://www.ssa.gov/myaccount/

According to the National Public Pension Coalition, employer-sponsored defined benefit plans (like KCPSRS) and social security are the bedrock of retirement security.

Jim Roehner October 19th, 2016

Posted In: Uncategorized